The Accountant – Issue 2 of 2021 (MIA Publication)

There are many ways how a collective input of hundreds of hours can be spent. For an ad-hoc working group set up by the MIA’s Financial Reporting Committee, those hours translated into an analysis of the proper application of existing accounting standards to new tax legislation. Many discussions later, including meeting a member of a standard-setter on the other side of the world, the MIA issued its TECH 01/21 guidance note “Fiscal Unit Consolidation Guidance” which is available in the e-library on our website.

For many years Maltese taxpayer companies forming part of the same group were required to prepare and submit individual tax returns. Subject to satisfying the respective requirements in tax legislation, loss-making companies could surrender losses to profit-making companies within their group, and shareholders could claim a partial refund of tax paid by a subsidiary, provided that the latter had paid its tax due and declared a dividend. Refunds could take a period of time to be processed, with the cash flow implications that this brings with it.

That all changed with effect from tax year of assessment 2020 with the introduction of the Consolidated Group (Income Tax) Rules (the Rules), which make it possible for a group of companies (the “fiscal unit”) to prepare a single tax return on the basis of their consolidated results. Subsidiaries must meet certain requirements to be allowed to form part of the fiscal unit.

In practice, this means that loss-making companies within a fiscal unit will no longer need to surrender their losses. Perhaps more importantly, a fiscal unit’s tax liabilities are measured at its blended tax rate, which is a net rate obtained after taking into consideration any refunds that the shareholder would have been entitled to claim had a fiscal unit not been formed and the investee had declared a dividend for the full amount of its profits available for distribution. This means that:

investors who qualified for a refund of taxes paid by their investees no longer need to fund the investee’s tax payment in full, only to subsequently receive a partial refund; and

investee companies are no longer required to declare dividends in order for investors to maximise tax efficiency.

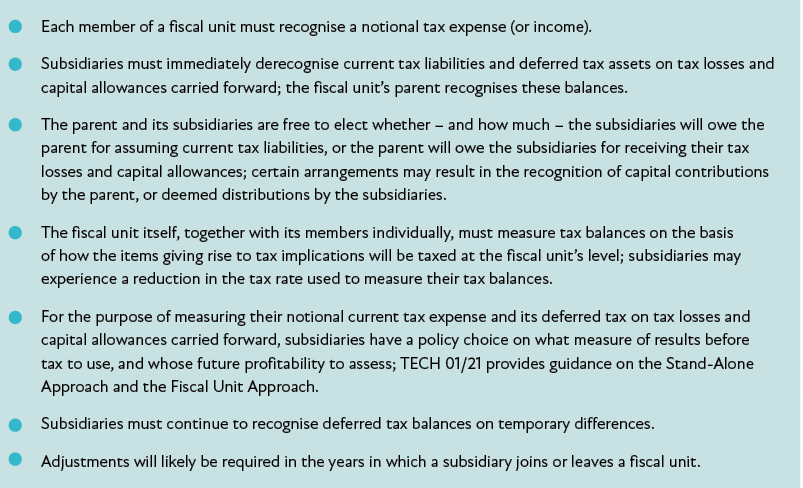

The most challenging of impacts to us members of the profession relate to recognition and measurement of tax assets and liabilities, with a summary of the key conclusions from TECH 01/21 set out in Figure 1.

Figure 1: Key accounting implications arising from the Rules

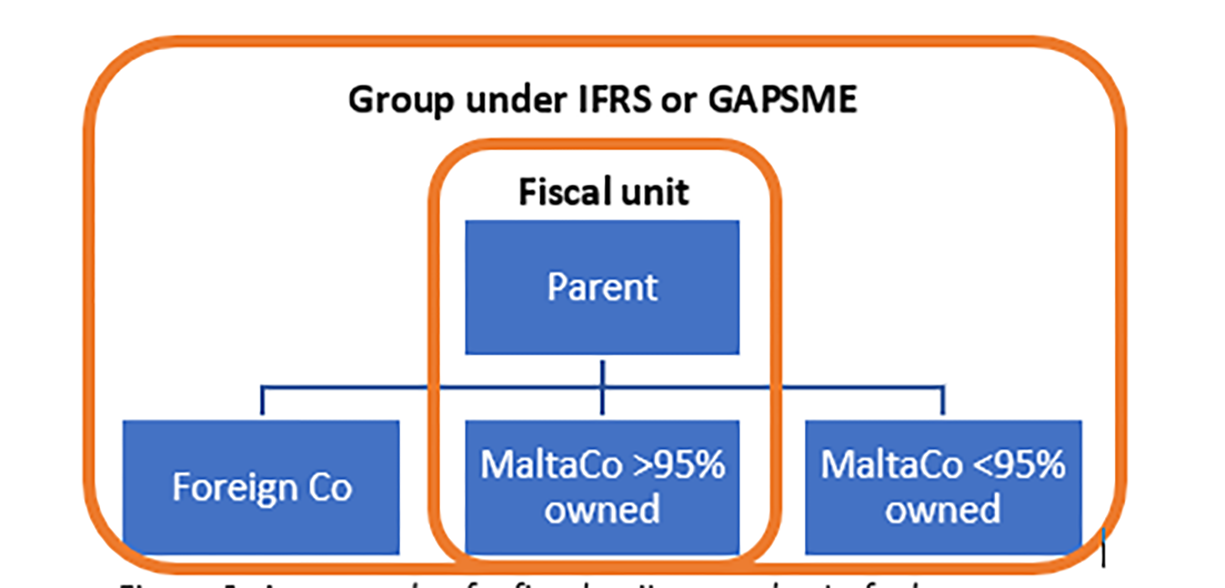

The Rules also require a fiscal unit to prepare consolidated financial information which must be audited. If the fiscal unit already prepared and presented consolidated financial statements, those financial statements could be used to satisfy this requirement, but there may be situations where a fiscal unit is exempt from preparing consolidated financial statements for company law purposes or, as illustrated in Figure 2, a fiscal unit is only a subset of the group of companies which prepares consolidated financial statements for company law purposes. In these situations, the fiscal unit’s consolidated financial information must follow the recognition and measurement, as well as the presentation and disclosure requirements of IFRS or GAPSME. However, the guidelines issued by the Commissioner for Revenue include a list of items that may be excluded from the notes, with the result that the consolidated financial information is drawn up under a compliance framework rather than a fair presentation framework.

Figure 2: An example of a fiscal unit as a subset of a larger group

TECH 01/21 [Login details required] includes detailed guidance on the accounting and auditing implications of the Rules.

David Leone Ganado specialises in technical accounting and provides advice and training on complex matters under IFRS and GAPSME. He is a member of the MIA’s Financial Reporting Committee and is the founder of Accounting Advice by David Leone Ganado